Isn’t a shame you can’t download a college financial aid counselor, complete with aid maximization strategies, worksheets, term explanations, and charts? It would be if this manual weren’t available to you.

The MaxFinAid Manual is our way of getting what we know into your heads, and thereby into your financial aid planning. It’s got everything you could want from a downloadable counselor, and more.

And now that information is more accessible than ever. In addition to the full version (downloadable below), the entire contents of the manual are here online.

Download the whole thing for free here:

Financial aid is money that can help you pay for college. Some aid needs to be paid back or earned, and some aid is a gift. This money is available to all kinds of people. Here are seven important things you should know about financial aid.

Would you like to maximize you’re financial aid? Who wouldn’t? Yet, every year students miss out on financial aid dollars for a variety of reasons. In 2004, the American Council on Education released a study on financial aid and found that half of the undergraduates that enrolled in college never filled out the financial aid form. This is tragic! The study concluded that, “850,000 of those students would have been eligible for a Pell Grant, the principal federal grant for low-income students.” That’s money that was simply left on the table, because a form wasn’t filled out. So to avoid leaving money on the table, be sure you’re following the “Five Golden Rules of Financial Aid.”

Rule #1 – You must thoroughly understand the college financial aid process. Once you know how it works, you can learn how to make it work in your favor.

As Sir Francis Bacon would say, “Knowledge is power.” Never could this be truer than with financial aid. Aid doesn’t necessarily go to those with the greatest need, but sadly to those who understand the rules of the game. Imagine playing a board game like Monopoly and not knowing the rules! You’d soon find yourself bankrupt and mortgaged out of the game.

So too with financial aid. Do you know what FAFSA is? Or how to lower your EFC? Do you understand the difference between a subsidized and a unsubsidized loan? How should you handle gift money from grandparents that want to help pay for college? Is a college 529 savings plan a good investment? What you don’t know about financial aid, can hurt you financially and potentially impact your future education.

If you’ve heard about any of the effects of the housing crisis, you may know how difficult it is to try and sell a home when the market is down. In fact, it’s so difficult that a whole new business industry called, “home staging,” has sprung up. The job of the home stager is to make your house look as favorable to a potential buyer as possible. They arrange the furniture, plants, and décor in just the right way, to make the best impression. Studies show that buyers decide on whether to buy a home within the first 30 seconds of being in the home! So, a home seller wants to make sure their house is packaged for just the right buyer.

Now imagine that you are trying to sell a very unique product that we’ll call, “YOU.” Even more, we’re looking for just the right college to sell YOU to. However, the college has hundreds, if not thousands, of potential students to choose from. How do you get YOU to stand out from the rest? The answer is golden rule #2:

Golden Rule #2: You need to know how to favorably package yourself and your family’s financial situation for schools that you want to attend.

Just like in “staging” a home for the best buyer, you need to stage (or package) yourself for the best college. To do this, you need to do a little research on your college of choice in order to put together the best package.

For this package, you’ll need to know two key pieces of information. First, what is the DNA of the college? By DNA, I refer to any number of words that relate to its ethos, atmosphere, community, culture, climate, etc. Every college has a certain “feel” to it and a certain type of student that they are looking for. Do you know the school’s culture? More importantly, do you fit the culture of the school? The last thing you want to be is a square peg trying to fit in a round hole; and that’s what a mismatch in culture would feel like. This is why a sight visit (or preview) to a college is so important in understanding the type of learning environment you are coming into.

Second, you need to know how to present your family’s financial situation in the most favorable light. Again, this will require some research on your part in understanding how FAFSA handles different types of income, assets and other financial resources. In addition, colleges can ask for more specific information beyond what FAFSA asks for, sometimes called a “profile” form. Knowing this upfront and the types of questions you’ll be asked, will help you get ready to “stage” yourself in the best possible light.

If this seems all a little overwhelming, don’t worry. You’re already ahead in the game by being here and learning more! Take the next step in creating the best “package” of YOU by downloading the free financial aid manual.

Have you ever walked into a high tech computer store to buy a computer? Friendly sales people will fill your head with RAM, gigabytes, core processors, hard drive space, pixels, and bus speeds until you have no idea what to do. Last time I went through this ordeal, I walked out with a brand new computer with Windows Vista loaded and was promised this was the operating system of the future (LOL).

Selecting a college can be just as daunting if not more so. You’re making a potential $100,000 investment in your future. What’s more, the financial aid award letters are confusing due to complex terminology and jargon. How do you compare apples-to-apples? It’s so bad, in fact, that a bill was introduced this year in the US Senate, called the Understanding the True Costs of College Act, to clarify financial aid award letters from colleges. So, what do you do while waiting for congress to fix the mess?

Golden Rule #3 states: You must become an “educated consumer” so the process doesn’t intimidate you. Unless you shop around and learn something about how each school handles their financial aid process, you’ll never be able to separate the good offers from the bad.

Every college has, in its financial aid bag of tricks, ways to appeal and entice you. Some parts of these packages are good; some parts of them are not. Some schools have large endowments that they use for their scholarship funds, others “rob Peter to pay Paul” with financial aid. Obviously you want to be Paul in those cases, but you’ll need to understand the school’s financial process to do so.

I don’t like conflict, so when I purchased my last home, I hired a real estate agent to walk me through the financial purchase. This was quite a relief for me as my agent asked for, debated and advocated on my behalf, saving me thousands of dollars.

Unfortunately, when you enter the college financial aid process, there is no agent who speaks on your behalf. You are very much alone in lobbying for your financial aid. If like me, you find this difficult to do, don’t hesitate to enlist the help of a parent, guidance counselor or friend. Here is the golden rule you need to know:

Golden Rule #4: You need to possess negotiation skills to assist you in enhancing your initial financial aid position. Developing the ability to lobby your interests is crucial for getting the most aid possible. And most financial aid officers will be willing to listen—provided you can make your case.

When I received my daughter’s award letter last year I found, to my horror, that her aid had been cut by nearly $8,000 from the previous year. Initially, my daughter wanted to give up, throw-in-the-towel and transfer to a cheaper community college. Rather than accept defeat, I called the financial aid officer of her college. Again, I don’t like conflict, but I felt someone needed to advocate on my daughter’s behalf and, well… there wasn’t anyone else.

When I called the financial aid officer, I was polite, but candid about our financial situation. Essentially, I said something like this: “I’m not looking for a free ride, but the truth is that my daughter can’t go into debt that much. It’s not a good financial investment and this award letter is a deal breaker for us. Here’s how much debt I think we can realistically take on…”

The officer listened politely, asked questions for clarification and made suggestions. In the end, she said she would look at the numbers again and call me later. A week later, she came back with an aid package that met all our requests.

If I learned anything from this experience it was that we “have not because we ask not.” Don’t be intimidated by the process. Open a dialogue with your financial aid officer, make your case and you may be surprised with the outcome.

Hiring managers today get too many applications for employment, especially in the current economy. With unemployment rates hovering in the 7-8% range, you might say that it’s an “employer’s market.” Hiring managers need to quickly weed the stack of applications received down to something more manageable. HR departments step in to help managers by first separating out those who have a college degree from those who don’t. Those without the degree quickly get set aside and may never be considered. While this may not seem fair, it does demonstrate the tangible value of a college degree in today’s job market. A college degree proves that you can read, write and articulate ideas. It shows that you have persistence to make it through four years and can accomplish your goals in the face of difficult challenges.

In addition, the Bureau of Labor and Statistics estimates that weekly earnings for 2012 for those with a college degree to be 60% more than those with a high school degree. Those with a college degree experienced unemployment at nearly half the level of those with a high school degree. Over a lifetime this pays off, to the tune of $2.27 million (see US News & World Report).

So, here’s rule #5:

Rule #5: You need to understand that your future rests solidly on the education you get. At times it may seem difficult or even impossible, but it will pay off if you persevere. A quality education opens so many doors that would otherwise be shut, locked, and bolted. Tightly.

This is not to say that money is the only thing. A college degree has many benefits and opportunities that are not as tangible. According to Morton Schapiro, president and professor of economics at Northwestern University, et.al., “People with higher levels of education are more likely to have rewarding jobs, more likely to exercise regularly, less likely to smoke, more likely to be active voters and volunteers, and more likely to engage in activities with their children.” In short, a college degree benefits both the individual and society as a whole.

Know how your Expected Family Contribution (EFC) is calculated.

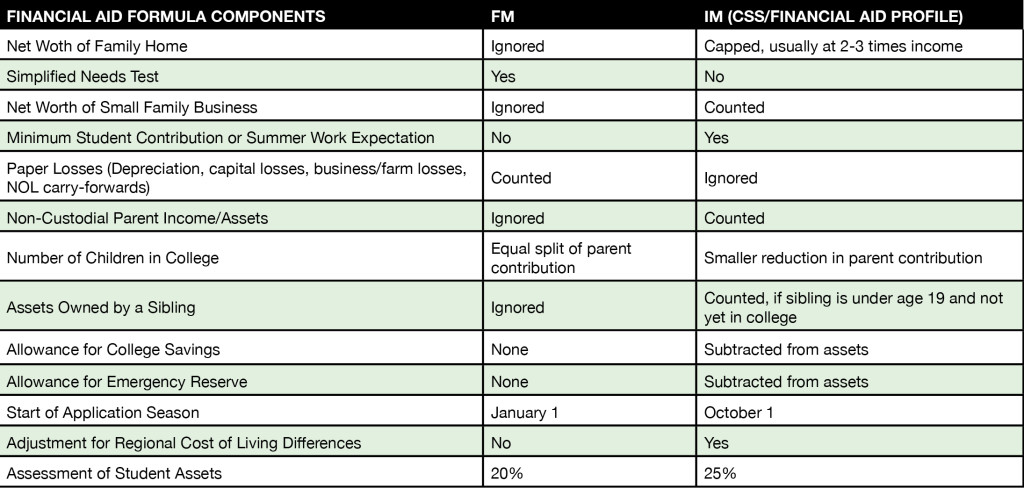

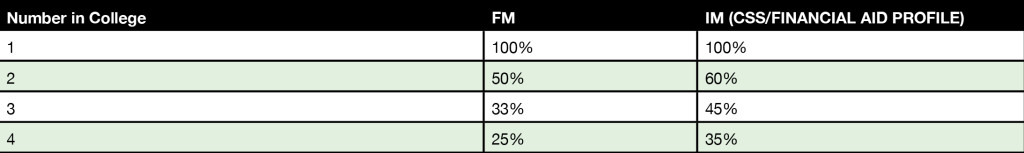

There are two formulas for calculating a student’s Expected Family Contribution (EFC). They are:

The Federal Needs Analysis Method or Federal Methodology (FM) and Institutional Methodology (IM) used by over 250 private colleges.

Here are a few differences between the two:

Check out this video, how many student’s can relate to this?